Neobanking Market Worldwide: Insights into User Growth, Monetization, and Fintech Adoption

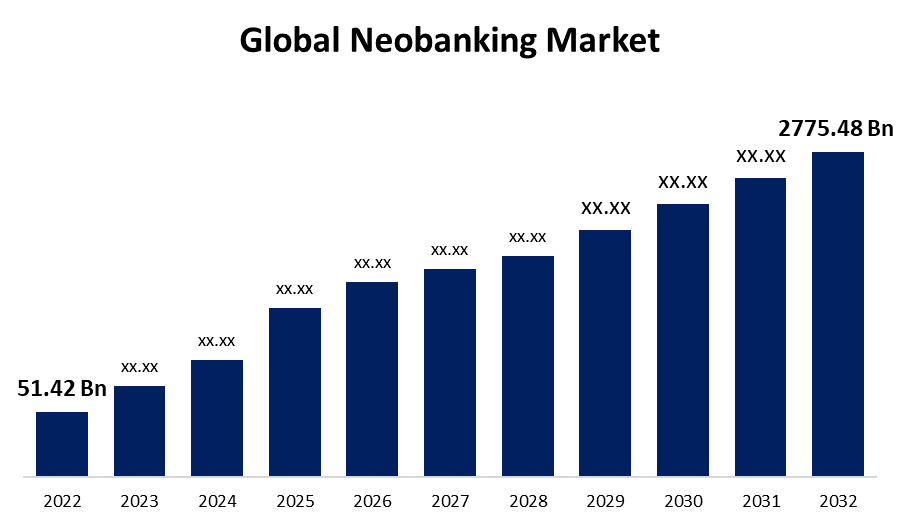

According to a research report published by Spherical Insights & Consulting, the Global Neobanking Market Size is Expected to Grow from USD 76.62 Billion in 2023 to USD 4136.49 Billion by 2033, at a CAGR of 49.01% during the forecast period 2023-2033.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/2913

Neobanks are digital, electronic, internet-only, or online financial institutions that do not have physical branch networks. They provide clients with a consolidated dashboard for managing accounting, reconciliations, and payments by collaborating with licensed banks and automating financial procedures through API banking. Neobanks are fintech firms offering automated, mobile-first financial services like installments, money transfers, and loaning. They operate between cash inflow and loaning, reducing client expenses and providing customized services through technology. The market for neobanking is growing as a result of shifting customer behavior, internet penetration, and digital technologies. Smartphone adoption, the need for online financial services, the growth of fintech infrastructure, and partnerships with conventional banks are its main drivers. For instance, to facilitate quicker and simpler online and in-store payments, Revolut announced that Google Pay would be available to its customers in Greece, Bulgaria, Estonia, Austria, Hungary, Lithuania, Latvia, Portugal, the Netherlands, and Romania starting. However, the growing frequency and strength of mobile malware assaults provide issues for the worldwide neobanking business in terms of authenticity and financial security.

Browse key industry insights spread across 230 pages with 135 Market data tables and figures & charts from the report on the Global Neobanking Market Size, Share, and COVID-19 Impact Analysis, By Account Type (Business account, Savings account), By Services (Mobile-banking, Payments, money transfers, savings, Loans, Others), By Application Type (Personal, Enterprises, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Buy Now Full Report: https://www.sphericalinsights.com/checkout/2913

The business account segment is predicted to hold the largest market share through the forecast period.

Based on the account type, the neobanking market is classified into business account and savings account. Among these, the business account segment is predicted to hold the largest market share through the forecast period. Global corporations are increasingly using neobanking for significant payouts because of its straightforward disbursal procedures, which minimize human participation and are predicted to accelerate segment expansion.

The money transfer segment is anticipated to hold the greatest market share during the projected timeframe.

Based on the services, the neobanking market is divided into mobile-banking, payments, money transfers, savings, loans, and others. Among these, the money transfer segment is anticipated to hold the greatest market share during the projected timeframe. Customers may move money between accounts quickly and easily using online money transfers, which eliminates the need to visit train stations or airports to purchase tickets. As a result, this category is expected to hold the biggest market share during the projected period.

The enterprise segment is anticipated to hold the largest market share during the projected timeframe.

Based on the application type, the neobanking market is divided into personal, enterprises, and other applications. Among these, the enterprise segment is anticipated to hold the largest market share during the projected timeframe. Enterprise platforms offer a variety of services, including asset management, transaction management, and credit management. Several neobank service providers for SMEs are attempting to improve customer satisfaction by expanding their product portfolios through acquisitions.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/2913

Europe is estimated to hold the largest share of the neobanking market over the forecast period.

Europe is estimated to hold the largest share of the neobanking market over the forecast period. The creation of novel technologies and the early adoption of new ones are responsible for the expansion of the regional market. To improve their position in the market, businesses are establishing alliances and introducing product platforms. Opportunities for market expansion have been created by a number of regional neobanks establishing physical distribution channels to implement an O2O distribution model.

Asia Pacific is predicted to have the fastest CAGR growth in the neobanking market over the forecast period. The market is expected to develop faster due to the rise of smartphones and internet services. Younger demographics and the emergence of digital-only banks in China, India, and Japan will also support regional market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the carpet backing materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major key players in the neobanking market include Movencorp Inc., Mybank, N26, Revolut Ltd., Simple Finance Technology Corp., Ubank Limited, Webank, Inc., Atom Bank PLC, Fidor Bank Ag, Monzo Bank Ltd, and Others.

Recent Development

- In July 2024, Launching the first personal loan solution via the Open Network for Digital Commerce (ONDC) is a major step for BranchX. This program intends to improve financial inclusion for the 1.4 billion people who live in India, with a focus on young professionals, entrepreneurs, small business owners, and the developing middle class1. Using the ONDC architecture, BranchX provides a digital-first strategy that guarantees a transparent and paperless loan application and payout procedure.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the neobanking market based on the below-mentioned segments:

Global Neobanking Market, By Account Type

- Business account

- Savings account

Global Neobanking Market, By Services

- Mobile-banking

- Payments

- Money Transfers

- Savings

- Loans

- Others

Global Neobanking Market, By Application Type

- Personal

- Enterprises

- Other Applications

Global Neobanking Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browser Related URL

Global Digital Banking Platform Market Size, Share, and COVID-19 Impact Analysis, By Deployment (On-Premise and Cloud), By Mode (Online Banking and Digital Banking), By Component (Platforms and Services), By Service (Platform segment and Managed Service), By Type (Retail Banking, Corporate Banking and Investment Banking) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

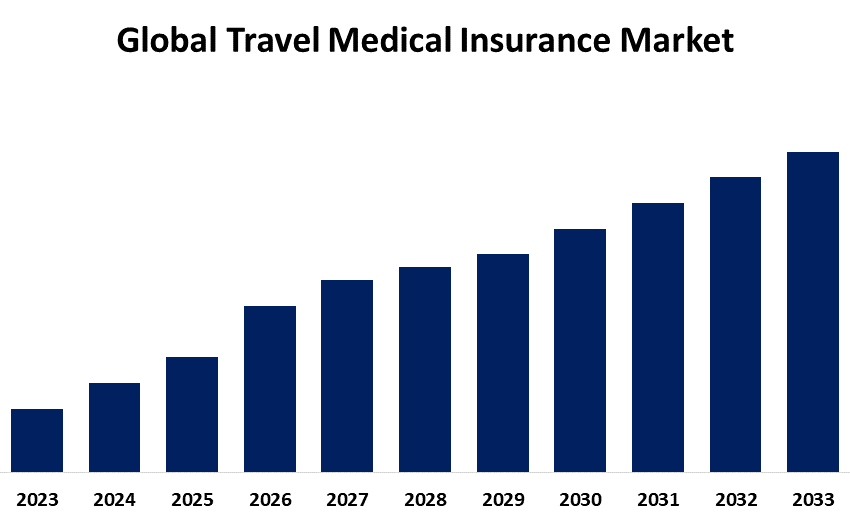

Global Travel Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Annual Multi-Trip Travel Insurance and Single-Trip Travel Insurance), By Distribution Channel (Insurance Brokers, Insurance Companies, Banks, Insurance Aggregators, and Insurance Intermediaries), and By End User (Family Travelers, Education Travelers, Business Travelers, Senior Citizens, and Others), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2021 – 2030

Global Crop Insurance Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Type (Multiple Peril Crop Insurance, Actual Production History, and Crop Revenue Coverage), By Coverage (Localized Calamities, Sowing/Planting/Germination Risk, Standing Crop Loss, and Post-harvest Losses), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Global Contract or Temporary Staffing Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Type (Temporary Staffing, Permanent Staffing), By Services (General Staffing, Professional Staffing), By Channel (Online, Offline) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company’s mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us