Agriculture Equipment Finance Market Overview: Global Insights and Investment Outlook

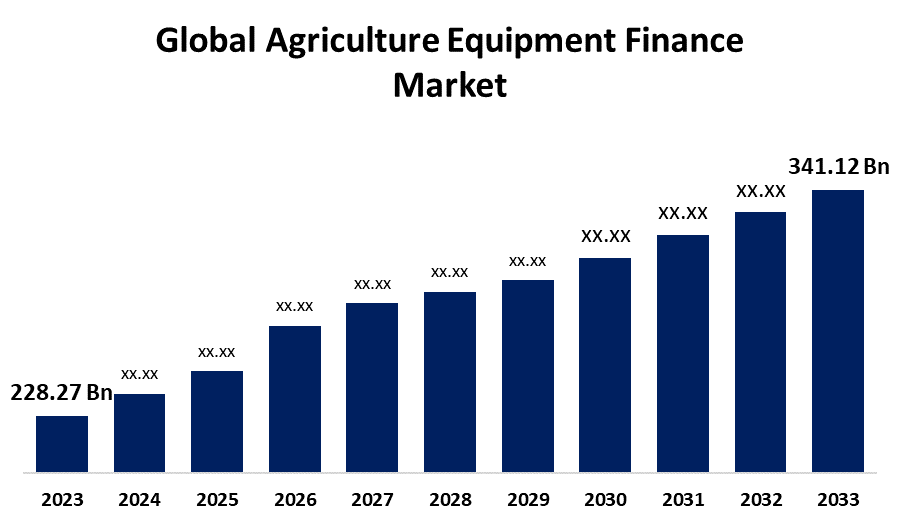

According to a research report published by Spherical Insights & Consulting, Global Agriculture Equipment Finance Market Size Expected to Grow from USD 228.27 Billion in 2023 to USD 341.12 Billion by 2033, at a CAGR of 4.10% during the forecast period 2023-2033.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/5504

Agriculture equipment finance is a service that assists farmers in purchasing or renting farm equipment. For farmers who need to buy new machinery, such as tractors, but lack the money upfront, it can be a smart choice. Farm equipment loans are frequently structured as business-term loans. Farmers borrow money in full from a lender and repay it over time, accruing interest. Loan payback terms for agricultural equipment can range from one to ten years, depending on the type of equipment the farmer is purchasing. Furthermore, the market for agricultural tractors is gradually developing as a result of the need for increased productivity and efficiency as well as the growing mechanization of the agricultural sector. However, one issue impeding the market’s growth is higher bank lending rates. Globalization of the economy as a whole has altered the supply and demand for financial products.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Agriculture Equipment Finance Market Size, Share, and COVID-19 Impact Analysis, By Type (Loans, Leases, and Line-of-Credit), By Product (Harvesters, Haying Equipment, Tractors, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Buy Now Full Report: https://www.sphericalinsights.com/checkout/5504

The lease segment is expected to hold the highest market revenue share through the projected period.

Based on the type, the agriculture equipment finance market is divided into loans, lease, and line-of-credit. Among these, the lease segment is expected to hold the highest market revenue share through the projected period. Leasing offers farmers a unique way to finance the assets they require now, with the option to purchase, trade, renew, or return the equipment at a later date. Additionally, farmers can take advantage of innovations, increased productivity, or better fuel efficiency through leasing, which enables them to try out the newest types of equipment without having to make a purchase commitment.

The tractors segment is estimated to hold the highest market share through the forecast period.

Based on the product, the agriculture equipment finance market is segmented into harvesters, haying equipment, tractors, and others. Among these, the tractors segment is estimated to hold the highest market share through the forecast period. Tractor loans for farmers are the industry norm for agricultural equipment. Tractor finance is necessary for businesses and industries. Thus, tractor loans are offered by top banks. The country’s rural and semi-urban areas have the highest demand for tractor finance.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/5504

Asia Pacific is expected to hold the largest share of the agriculture equipment finance market over the predicted timeframe.

Asia Pacific is estimated to hold the largest share of the agriculture equipment finance market over the predicted timeframe. This is because their economies heavily rely on agriculture, their populations are large, and their disposable money is increasing, the governments of emerging APAC countries like China, Japan, and India are focusing on low-cost methods to attain high agricultural productivity.

North America is estimated to grow at the fastest CAGR growth of the agriculture equipment finance market during the forecast period. The primary cause of the increase is large land areas, which has raised the demand for farm mechanization. In order to increase agricultural output, smart combine harvesters with monitoring sensors are also becoming more and more popular in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Agriculture Equipment Finance Market are Adani Group, AGCO Corp., Agricultural Bank of China Ltd., Argo Tractors SpA, Barclays PLC, BlackRock Inc., BNP Paribas SA, Citigroup Inc., Deere and Co., ICICI Bank Ltd., IDFC FIRST Bank Ltd., IndusInd Bank Ltd., JPMorgan Chase and Co., Key Corp., Larsen and Toubro Ltd., Mahindra and Mahindra Ltd., and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In March 2024, a low-cost sustainable finance initiative for farmers was launched by Tesco and NatWest. The cooperative effort aims to help 1,500 Tesco-affiliated farmers adopt sustainable farming practices by offering targeted funding.

- In May 2024, Westpac NZ is assisting Kiwi businesses in reducing their environmental impact by launching a new Sustainable Equipment Finance Loan. The new loan has a competitive five-year rate for corporate clients. It can be used to purchase a range of eco-friendly assets, including machinery, tools, and equipment that will reduce an organization’s carbon footprint, as well as company cars that operate on hydrogen or electricity.

- In December 2023, to enhance the customer experience, the Indian Bank partnered with Tractors and Farm Equipment Limited (TAFE) and TAFE Motors and Tractors Limited (TMTL), two of the country’s top tractor OEMs, to offer tractor financing. Farmers and other individuals would be able to get tractor loans through the collaboration at affordable interest rates, with the added advantage of easy loan processing.

- In August 2023, to finance farm equipment and tractors under the Kubota brand, the Bank of Baroda (BOB) and Kubota Agricultural Machinery India Pvt. Ltd. (KAI) inked a Letter of Understanding (MOU). With over 8200 branches nationwide, Bank of Baroda is one of India’s leading public sector banks. The Bank of Baroda will finance Kubota’s high-end tractor and farm equipment line at a fair interest rate.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the agriculture equipment finance market based on the below-mentioned segments:

Global Agriculture Equipment Finance Market, By Type

- Loans

- Leases

- Line-of-Credit

Global Agriculture Equipment Finance Market, By Product

- Harvesters

- Haying Equipment

- Tractors

- Others

Global Agriculture Equipment Finance Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related URL’s:

Global Plant Biotechnology Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Crop Protection & Nutrition Solution Products, Biotech Seed & Traits, and Synthetic Biology Enabled Products), By Technology (Genetic Engineering, RF Technology, Wi-Fi Technology, Imaging Technology, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Copra Cake Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Organic Copra Cake, Conventional Copra Cake, and Others), By Application (Animal Feed, Fertilizers, Biofuel, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Micro-Irrigation System Market Size, Share, and COVID-19 Impact Analysis, By Type (Drip Irrigation Systems, Sprinkler Irrigation Systems, and Other Micro-irrigation Systems), By Crop (Orchard Crops, Vineyards, Plantation Crops, and Field Crops), By End User (Farmers, Industrial Users, and other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 – 2030

Global Rice Seeds Market Size, Share, and COVID-19 Impact Analysis, By Type (Open-Pollinated Varieties and Commercial Hybrids), By Grain Size (Short Grain, Medium Grain, Long Grain), By Treatment (Treated and Untreated Seeds), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

- About the Spherical Insights & Consulting

- Spherical Insights& Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

- Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company’s mission is to work with businesses to achieve business objectives and maintain strategic improvements.

- CONTACT US:

- For More Information on Your Target Market, Please Contact Us Below:

- Phone:+1 303 800 4326 (the U.S.)

- Phone: +91 90289 24100 (APAC)

- Email: inquiry@sphericalinsights.com,sales@sphericalinsights.com

- Contact Us: https://www.sphericalinsights.com/contact-us

- Follow Us: LinkedIn| Facebook | Twitter