Travel Medical Insurance Market Analysis: Opportunities, Challenges, and Future Outlook

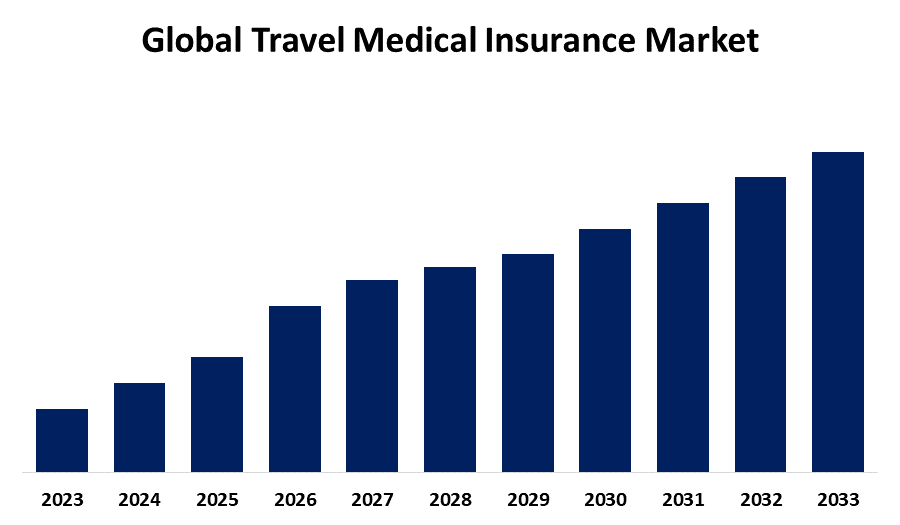

According to a research report published by Spherical Insights & Consulting, the Global Travel Medical Insurance Market Size is Expected to Grow at a CAGR of 12.6% during the forecast period 2023-2033.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/5608

A specialized plan that covers medical costs and health-related problems that arise while traveling is called travel medical insurance. Emergency medical care, hospitalization, evacuation, and repatriation services are all covered by travel medical insurance. It ensures that travelers have access to the medical care and support they require when traveling domestically or abroad, protecting them from unforeseen health risks and financial hardships during medical emergencies. For instance, Global travel insurance specialist Trawick International announced the release of a new line of international student insurance plans in June 2024 to give students studying overseas more options for health coverage. Increased awareness of medical risks, growing healthcare costs, and the volume of international travel all have an impact on the market for travel medical insurance. The market is growing as a result of global health crises, travel trends, regulatory requirements, technological advancements, adaptable insurance plans, and government initiatives. For instance, the Thai government will continue to provide foreign visitors with free health insurance through the end of 2024. Up to THB 500,000 ($13,650) in medical expenses for accidents or catastrophic events are covered by this program. The market is also influenced by consumer priorities and economic conditions. However, high premiums, intricate policy details, financial concerns, low awareness, and economic uncertainty are some of the obstacles facing the travel medical insurance market, which could restrict its global expansion.

Buy Now Full Report: https://www.sphericalinsights.com/checkout/5608

Browse key industry insights spread across 210 pages with 110 Market data tables and figures & charts from the report on the Global Travel Medical Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Single-Trip Travel Insurance, Multi-Trip Travel Insurance, Student travel insurance, Others), By Distribution Channel (Insurance Companies, Insurance Brokers, Banks, Travel Agencies, Others), By Application (International Travel, Domestic Travel, High-Risk Travel, Business Travel), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The single-trip travel insurance segment is predicted to hold the highest market share through the forecast period.

Based on the type, the travel medical insurance market is classified into single-trip travel insurance, multi-trip travel insurance, student travel insurance, and others. Among these, the single-trip travel insurance segment is predicted to hold the highest market share through the forecast period. As opposed to multi-trip plans, single-trip insurance is a popular option for both business and leisure travelers because of its ease of use, simplicity, and wide range of coverage options.

The insurance companies segment is anticipated to hold the greatest market share during the projected timeframe.

Based on the distribution channel, the travel medical insurance market is divided into insurance companies, insurance brokers, banks, travel agencies, and others. Among these, the insurance companies segment is anticipated to hold the greatest market share during the projected timeframe. Underwriting, managing, and offering travel medical insurance policies, as well as processing claims and offering customer service, make insurance companies essential to the market.

The international travel segment is anticipated to hold the largest market share during the projected timeframe.

Based on the application, the travel medical insurance market is divided into international travel, domestic travel, high-risk travel, and business travel. Among these, the international travel segment is anticipated to hold the largest market share during the projected timeframe. A surge in demand for comprehensive insurance coverage is causing the international travel segment to gain market leadership due to rising medical costs, regulatory requirements, and healthcare complexities.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/5608

North America is estimated to hold the largest share of the travel medical insurance market over the forecast period.

North America is estimated to hold the largest share of the travel medical insurance market over the forecast period. The region’s substantial market share in travel medical insurance is a result of its high volume of travel, high healthcare expenses, high level of benefit awareness, and high disposable incomes. Its position is further reinforced by reputable suppliers and advantageous regulatory frameworks.

Asia Pacific is predicted to have the fastest CAGR growth in the travel medical insurance market over the forecast period. The demand for travel medical insurance is being driven by economic growth, middle-class population expansion, and rising disposable incomes in the Asia Pacific region. The market is anticipated to grow as a result of improved insurance penetration, growing regional tourism, increased awareness, and infrastructure development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the travel medical insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major key players in the travel medical insurance market include Care Insurance, AwayCare, Bajaj Allianz Travel Insurance, Gerry’s Visa, TME TRAVEL INSURANCE, Razi Insurance Company, INF, Easy Insurance India, Just Travel Cover, National Insurance Travel Insurance, BSI Insurance Broker Ltd., New India Assurance Travel Insurance, Medical Travel Compared Limited, Europ Assistance South Africa, and Others.

Recent Development

- In August 2024, New online and offline insurance products that offer term insurance and a safety net against loan repayments have been introduced by the Life Insurance Corporation of India (LIC).

- In July 2024, the Life Insurance Corporation of India (LIC) launched new online and offline insurance products that provide term insurance and a safety net against loan repayments.

- In March 2024, Travel Guard Plus is a comprehensive travel insurance product that redefines full coverage for travelers with a variety of package plans, introduced by TATA AIG General Insurance Company Limited, a well-known general insurance provider.

- In January 2024, Allianz Partners announced the release of the Allyz mobile app, a digital platform that gives users access to the entire range of insurance benefits and reliable guidance and knowledge for travelers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the travel medical insurance market based on the below-mentioned segments:

Global Travel Medical Insurance Market, By Type

- Single-Trip Travel Insurance

- Multi-Trip Travel Insurance

- Student Travel Insurance

- Others

Global Travel Medical Insurance Market, By Distribution Channel

- Insurance Companies

- Insurance Brokers

- Banks

- Travel Agencies

- Others

Global Travel Medical Insurance Market, By Application

- International Travel

- Domestic Travel

- High-Risk Travel

- Business Travel

Global Travel Medical Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browser Related Reports:-

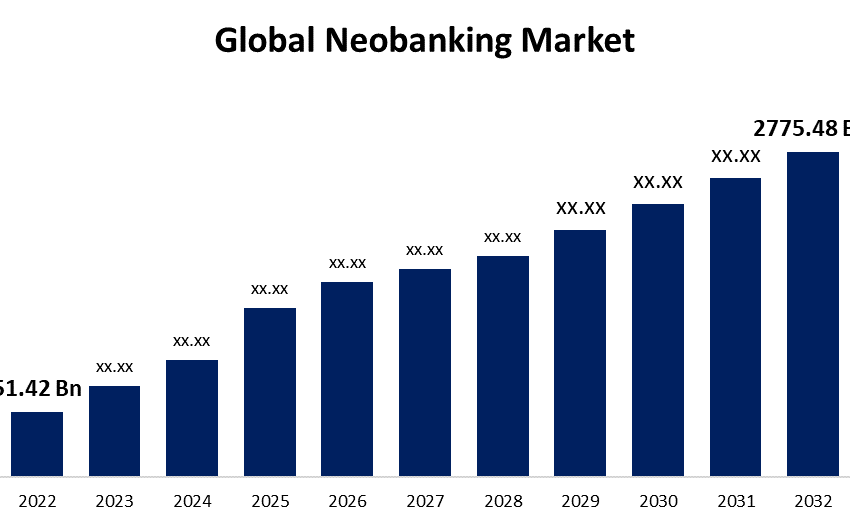

Global Financial Wellness Program Market Size, Share, and COVID-19 Impact Analysis, By Type (For Employers, For Employees), By Program (Financial Planning, Financial Education & Counseling, Retirement Planning, Debt Management, Others), By Application (Large Enterprises, Small & Medium Enterprises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

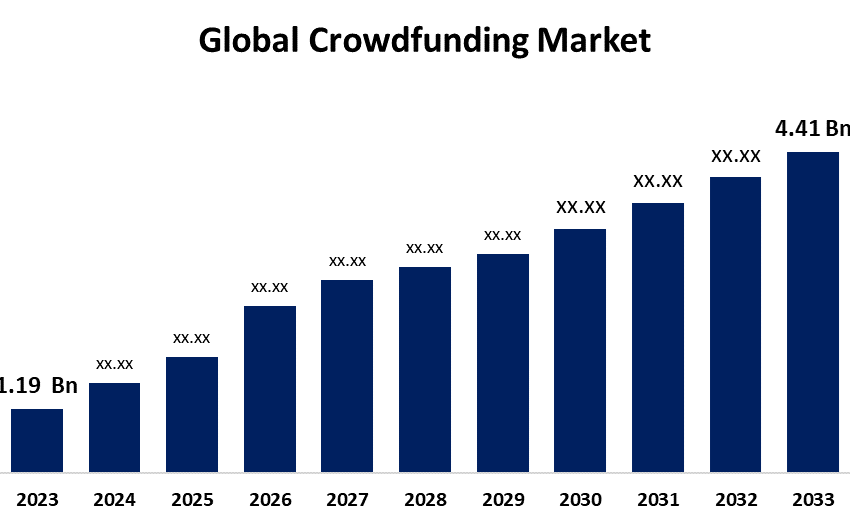

Global Fundraising Market Size, Share, and COVID-19 Impact Analysis, By Entity (Nonprofits, Corporate Foundations, Cause Marketing, Nonprofit Software), By Technique (Online Funding, Direct Funding, Event and Galas), By End-User (Non-Profit Organizations, Educational Institutes, Political Campaigns), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Travel Medical Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Single-Trip Travel Insurance, Multi-Trip Travel Insurance, Student travel insurance, Others), By Distribution Channel (Insurance Companies, Insurance Brokers, Banks, Travel Agencies, Others), By Application (International Travel, Domestic Travel, High-Risk Travel, Business Travel), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Consumer Finance Market Size, Share, and COVID-19 Impact Analysis, By Type (Secured Consumer Finance, Unsecured Consumer Finance), By Application (Bank & Financial Corporations, Non-Banking Financial Companies (NBFCs)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company’s mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter